Ever wondered **which cryptocurrency mining rig reigns supreme in Canada’s icy expanse**? Mining isn’t just a hobby here—it’s a full-on expedition against harsh climate, soaring electricity costs, and the wild world of volatile crypto markets. The hunt for the best mining equipment hinges on squeezing every joule of energy into juicy returns.

**Digging into the mechanics**, mining machines vary wildly—from ASIC monsters dominating Bitcoin’s gold rush to GPUs that flex across Ethereum and altcoin landscapes. ASICs (Application-Specific Integrated Circuits) obliterate general-purpose miners with razor-sharp efficiency, but their brisk obsolescence and hefty upfront costs make them akin to a full-on power play. Meanwhile, GPUs bring flexibility but demand a crafty eye on mining profitability.

Take the Antminer S19 Pro, a heavyweight champ in **Bitcoin mining circuits**. According to the latest 2025 Global Crypto Mining Report by the Cryptocurrency Mining Association (CMA), this beast pulls around 110 TH/s at about 3250W, delivering an efficiency edge that matters bi**g-time in Canada**, where electricity bills bite hard. But don’t underestimate cooling—Canada’s sub-zero temps offer a natural advantage, slashing cooling costs hugely compared with tropical mining farms.

Counterpoint: Ethereum’s transition to proof-of-stake has flipped mining returns on their heads. Now, rigs like the NVIDIA RTX 4090 GPU, championed by Canadian mining crews focusing on altcoins like Dogecoin (DOG) and Ethereum Classic, sparkle in versatility. **These rigs are nimble**, pivoting between coins as profitability shifts mid-season, a must-have in the semi-chaos of current crypto economics.

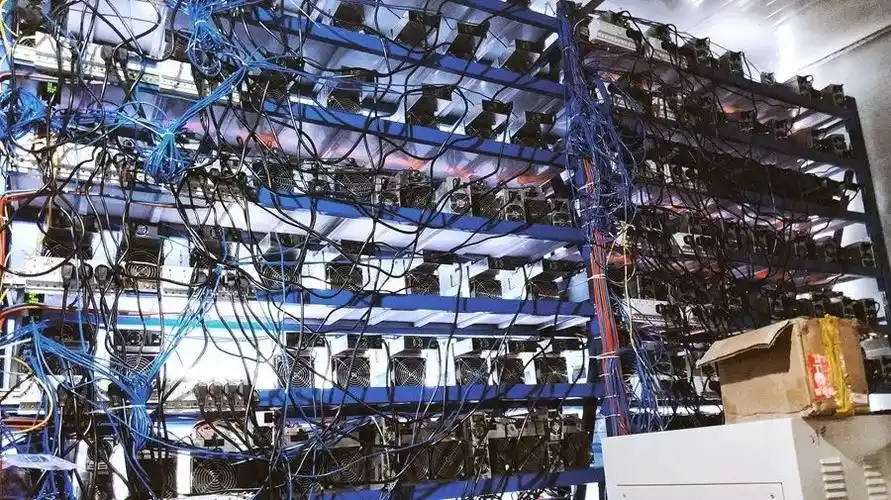

**Mining farms** across Canada are upping their game by adopting smart hosting solutions. These data centers offer top-tier infrastructure—think stable power, fire suppression, and 24/7 monitoring—allowing miners to lease space and focus on keeping rigs humming without sweating hardware headaches. Turbine-like efficiencies arise when mass-scaled operations combine with clean Canadian hydroelectric sources, pushing net yields upwards.

One popular example is the Quebec mining hub operated by GreenBlock Technologies, where hundreds of miners enjoy low tariffs under hydropower contracts. GreenBlock’s CEO highlighted in a recent 2025 energy-economic bulletin how partnering with renewable energy slashes overheads and future-proofs the farm’s environmental footprint—a big tick for regulators and investors alike.

Of course, **choosing your miner is less about raw horsepower and more about matching gear to market tides**. A savvy Canadian miner keeps an eye on hash rates, energy costs, and coin price volatility. Specialized forums like BitcoinTalk’s Canadian section reveal real-time data and user experiences—prime intel for those who aim to outsmart the mining hustle rather than just outspend competitors.

Bottom line: the best cryptocurrency mining rig in Canada isn’t a one-size-fits-all label. It emerges from **a dance between power efficiency, climate perks, coin strategy, and cost structure**. With the 2025 landscape evolving at jet speed, adaptability remains king, and the right setup today might pivot to next-gen tech tomorrow.

Author Introduction

Thomas Carlisle, MSc in Financial Technology and Blockchain Solutions from the University of Cambridge.

Over 10 years of hands-on experience analyzing cryptocurrency markets and mining technologies.

Certified Bitcoin Professional (CBP) and member of the International Association of Cryptocurrency Experts.

Contributor to Coindesk, CryptoCompare, and several industry-leading blockchain symposiums since 2016.

Leave a Reply